关于我们

FH.comFH体育(中国大陆)科技公司建立于1956年,原名“丹阳市化工机械有限公司”,1979年开始专业制造FH.comFH体育(中国大陆)科技公司 。

优越的地理环境和便捷的交通条件:公司位于江苏丹阳延陵镇凤凰工业园,地理位置优越,距南京87公里,上海180公里,镇江28公里,京杭大运河、312国道、京沪高速、沪宁铁路贯穿丹阳市境,常州机场在丹阳境内,水、陆、空交通发达,运输十分便捷 。

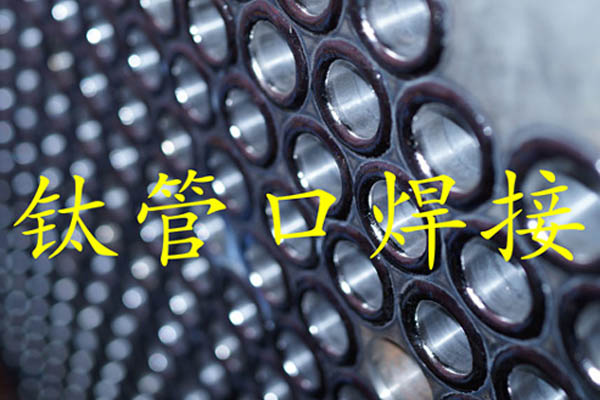

齐全的经营资质和运转良好的质保体系:公司专业从事D级FH.comFH体育(中国大陆)科技公司设计,A2级(含D级)贮存、反应、分离、热交换、塔器等碳钢、不锈钢FH.comFH体育(中国大陆)科技公司制造和化工装置的安装,同时具有锅炉FH.comFH体育(中国大陆)科技公司、压力管道焊工的培训考试条件和资格。有健全的质量保证体系,并通过ISO9000-2000质量体系认证。在2000年加入了中石化集团资源市场 。

1956

公司成立

1979

专业制造FH.comFH体育(中国大陆)科技公司

2000

中石化集团资源市场

150

检验、检测等设备

6大统一模式 护航产品

统一商业定位:

实现差异化竞争,提升整体竞争的综合实力。优越的地理环境和便捷的交通条件

统一规划设计:

齐全的经营资质和运转良好的质保体系在2000年加入了中石化集团资源市场 。

统一形象打造:

雄厚的基础实力和丰富的制作经验。保证产品的使用质量

统一服务管理:

集中所有的资源,走专业化道路,致力于FH.comFH体育(中国大陆)科技公司的设计、制造和安装领域的发展

统一运营管理:

不断优化产品结构,创建严谨、灵活的管理机制,以诚信巩固老客户,同时又以诚信结识新朋友

统一市场营销:

多年来与国有大型化工企业以及国外大型化工企业建立了良好的合作关系

新闻中心

SW6-2011V3.1测试版发布说明

FH.comFH体育(中国大陆)科技公司的前景分析

我们的优势

OUR ADVANTAGES

服务支持

FH.comFH体育(中国大陆)科技公司集中所有的资源,走专业化生产的道路,致力于FH.comFH体育(中国大陆)科技公司的设计、制造和安装领域的发展。努力成为行业尊重、社会认可、用户满意、效益良好的员工之家。

实力支持

公司现有员工200人,其中持证焊工60人,各类工程技术人员和有资质企管人员50人。现具备一、二类FH.comFH体育(中国大陆)科技公司的设计资格和A2级FH.comFH体育(中国大陆)科技公司制造资格,并通过了ISO9001-2000标准质量体系认证。

技术支持

产品的销售方向主要服务于石油化工、机电冶金、轻工食品等行业的中小型工程项目。公司目前已加入中石化集团资源市场,成为该集团网络成员。年生产能力7000吨。

OFFICIAL ACCOUNTS

公众号

欢迎关注我们的官方公众号

ONLINE MESSAGE

在线留言

◎2021 FH.comFH体育(中国大陆)科技公司.com All Rights Reserved. 备案号:苏ICP备17037576号-1 技术支持:新网